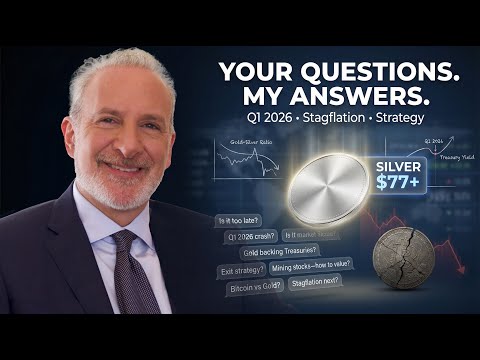

This is Part 2 (Q&A) of Peter Schiff’s X Spaces following the historic metals breakout. With silver near $77, platinum at all-time highs, and gold above $4,500, listeners pressed Peter on the questions that matter most: Is it too late? When do you sell? What happens in Q1 2026?

Peter addresses gold and silver pullback risk, exit strategies for precious metals and mining stocks, stagflation, Treasuries vs Swiss francs, the Federal Reserve’s next moves, and why he remains bearish on Bitcoin and crypto despite mainstream enthusiasm.

Topics covered include:

Is silver and gold overextended—or just getting started?

Q1 2026 risks: crash windows, catalysts, and timing

Gold backing Treasuries and central bank behavior

Stagflation, rates, oil, copper, and energy costs

How to value gold and silver mining stocks (juniors vs majors)

Exit strategy: technical and fundamental sell signals

Bitcoin vs gold, Ethereum, and why Schiff rejects crypto

Portfolio advice for 401k holders with no metals exposure

Recorded live during U.S. market hours while mainstream media looked the other way.

Not financial advice. Do your own research.

Link to full X Spaces: https://x.com/PeterSchiff/status/2004628708858921380

Follow @peterschiff

X: https://twitter.com/peterschiff

Instagram: https://instagram.com/peterschiff

TikTok: https://tiktok.com/@peterschiffofficial

Facebook: https://facebook.com/peterschiff

Book Store: https://schiffradio.com/books

#BitcoinCrash #SilverInvestment #EconomicPolicies